All Categories

Featured

Table of Contents

Investments involve risk; Equitybee Securities, participant FINRA Accredited financiers are the most competent investors in the service. To qualify, you'll need to meet several demands in earnings, net well worth, asset dimension, governance standing, or specialist experience. As a certified investor, you have access to a lot more complex and sophisticated kinds of securities.

Enjoy accessibility to these alternate financial investment possibilities as an approved investor. Accredited capitalists typically have an earnings of over $200,000 individually or $300,000 jointly with a partner in each of the last two years.

Optimized Passive Income For Accredited Investors for Accredited Investment Results

To gain, you just require to subscribe, buy a note offering, and wait on its maturation. It's a great resource of passive income as you do not need to check it very closely and it has a short holding duration. Good annual returns vary in between 15% and 24% for this asset course.

Potential for high returnsShort holding period Capital in jeopardy if the borrower defaults AssetsContemporary ArtMinimum Financial investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes blue-chip art work for financial investments. It gets an artwork via auction, after that it signs up that possession as an LLC. Starting at $15,000, you can buy this low-risk property course.

Get when it's supplied, and after that you get pro-rated gains when Masterworks markets the artwork. Although the target period is 3-10 years, when the artwork reaches the wanted worth, it can be offered previously. On its website, the most effective appreciation of an art work was a whopping 788.9%, and it was just held for 29 days.

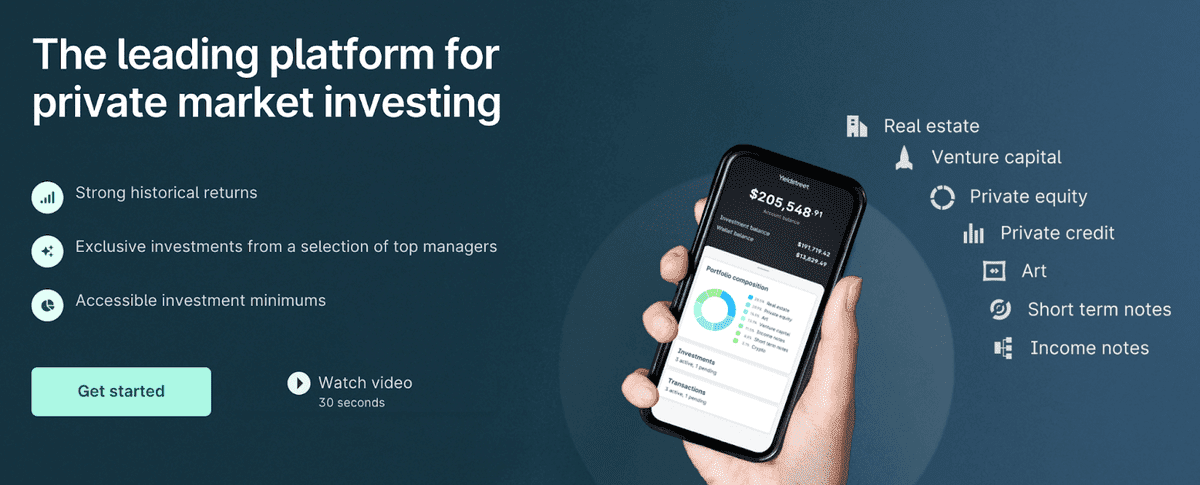

Its minimum begins at $10,000. Yieldstreet has the broadest offering across different investment systems, so the amount you can make and its holding duration differ. There are items that you can hold for as short as 3 months and as long as 5 years. Usually, you can earn via dividends and share admiration with time.

Accredited Investor Property Investment Deals

One of the disadvantages here is the reduced annual return rate contrasted to specialized systems. Its monitoring charge normally varies from 1% - 4% yearly. passive income for accredited investors.

It turns farmland commercial. Furthermore, it receives rent earnings from the farmers during the holding duration. As a capitalist, you can gain in two ways: Get dividends or money return every December from the rent paid by occupant farmers. Gain pro-rated income from the sale of the farmland at the end of the holding duration.

Turnkey Accredited Investor Crowdfunding Opportunities for Accredited Investor Deals

Farmland as an asset has traditionally low volatility, which makes this an excellent choice for risk-averse capitalists. That being stated, all financial investments still bring a specific degree of danger.

Furthermore, there's a 5% charge upon the sale of the entire home. It spends in numerous bargains such as multifamily, self-storage, and commercial residential properties.

Taken care of fund by CrowdStreet Advisors, which automatically diversifies your investment across different properties. accredited investor real estate investment networks. When you spend in a CrowdStreet offering, you can obtain both a cash money yield and pro-rated gains at the end of the holding duration. The minimum financial investment can vary, yet it usually starts at $25,000 for market offerings and C-REIT

While some assets may return 88% in 0 (accredited investor funding opportunities).6 years, some assets lose their value 100%. In the background of CrowdStreet, even more than 10 properties have negative 100% returns.

Advanced Exclusive Deals For Accredited Investors

While you won't get ownership right here, you can potentially get a share of the profit once the start-up efficiently does an exit occasion, like an IPO or M&A. Numerous excellent firms stay personal and, as a result, usually unattainable to financiers. At Equitybee, you can fund the stock choices of employees at Stripe, Reddit, and Starlink.

The minimal financial investment is $10,000. This platform can possibly offer you huge returns, you can additionally shed your entire money if the start-up fails. Since the transfer of the protections is hand-operated, there's a danger that employees will certainly decline to follow by the contract. In this instance, Equitybee will exercise its power of lawyer to educate the company of the stock to launch the transfer.

When it's time to work out the option throughout an IPO or M&A, they can benefit from the potential increase of the share rate by having a contract that enables them to acquire it at a discount (private equity for accredited investors). Accessibility Numerous Startups at Past Valuations Diversify Your Profile with High Development Start-ups Purchase a Formerly Unattainable Property Course Subject to availability

It can either be 3, 6, or 9 months long and has a set APY of 6% to 7.4%. Historically, this income fund has actually outperformed the Yieldstreet Option Revenue Fund (formerly known as Yieldstreet Prism Fund) and PIMCO Revenue Fund.

Market-Leading Accredited Investor Financial Growth Opportunities

Various other functions you can buy consist of acquiring and holding shares of industrial areas such as industrial and multifamily properties. Some users have whined concerning their absence of transparency. Apparently, EquityMultiple does not interact losses without delay. Plus, they no much longer publish the historic performance of each fund. Temporary note with high returns Absence of openness Facility fees structure You can qualify as an accredited capitalist utilizing two requirements: monetary and expert abilities.

There's no "test" that approves an accreditor investor permit. One of the most essential points for a recognized investor is to secure their resources and expand it at the same time, so we chose assets that can match such different danger cravings. Modern spending platforms, particularly those that offer alternative possessions, can be rather uncertain.

To guarantee that accredited financiers will certainly be able to form a comprehensive and varied profile, we picked platforms that could meet each liquidity demand from temporary to lasting holdings. There are numerous financial investment opportunities certified investors can discover. Some are riskier than others, and it would depend on your threat cravings whether you would certainly go for it or not.

Recognized financiers can expand their investment profiles by accessing a broader variety of possession classes and financial investment methods. This diversification can help alleviate threat and enhance their overall portfolio performance (by avoiding a high drawdown portion) by lowering the dependence on any solitary investment or market industry. Approved capitalists usually have the opportunity to link and work together with various other like-minded financiers, market professionals, and business owners.

Table of Contents

Latest Posts

Excess Proceeds List

Tax Default Houses

Foreclosure For Taxes

More

Latest Posts

Excess Proceeds List

Tax Default Houses

Foreclosure For Taxes